USAA offers excellent customer service and top-notch coverage if you’re looking for an insurance company. Their rates are always competitive and they have been in business for more than 100 years, making them one of the best insurance companies in America.

USAA: what is it?

Insurance, banking, and other financial services are among the specialties of USAA. Founded in 1922, USAA is one of the world’s largest insurance companies. In addition to its excellent customer service, USAA is dedicated to helping members maximize the value of their insurance policies and banking products.

One of the world’s largest insurance companies, USAA has more than 60 million customers worldwide. In addition to life insurance, health insurance, auto insurance, home insurance, small business insurance, and vacation insurance, it provides banking services such as checking accounts, savings accounts, mortgages, loans, and credit cards, as well as investment advice.

There is no doubt that USAA is renowned for its excellent customer service. USAA provides members with 24 hour access to its customer service professionals via phone or online chat, as well as a variety of resources on its website, including FAQs and how-to videos. On USAA’s website, members can also submit a request for assistance through the Contact Us form.

With our insurance policies and banking products, USAA strives to make sure members get the most out of them. The USAA Policyholder Help Center (PHC), for example, provides members with free access to information on how to use their policy benefits and check their account balances. Also, USAA offers members discounts on mortgage rates and car insurance premiums.

Getting a Quote

Now is the perfect time to switch to USAA.

J.D. Power and Associates recently named the San Antonio-based company the best insurance company in America.

USAA had to rank among the top three insurers nationwide in five categories: customer service, claims handling, pricing, products and website usability.

“We are very proud of this achievement,” says USAA CEO Howard Schneider. “It shows our commitment to members.”

With its headquarters in San Antonio, USAA has been providing quality insurance products since 1922. USAA offers its 26 million members a variety of benefits, including: financial planning services; roadside assistance; military discounts; and free or reduced-price car insurance through an alliance with Geico.

Insurance Types

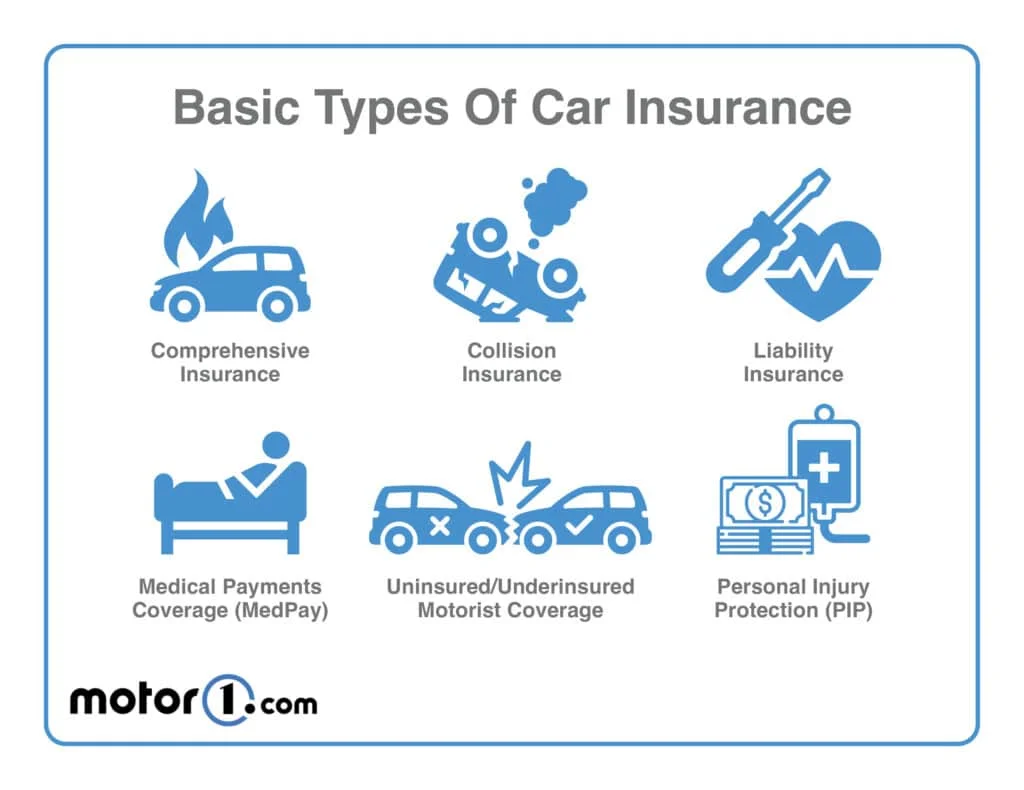

USAA offers many types of insurance, and it’s important to know what options are available to you in order to get the best coverage.

USAA offers a variety of auto insurance policies, including standard, collision, and comprehensive coverage. You can choose between a month-to-month or fixed-term policy, and if your vehicle qualifies, an accident forgiveness option is available.

In addition to personal property and liability coverage, USAA can provide coverage for flood damage, fire damage, vandalism, and theft if you own a home.

If you’re renting an apartment or house, make sure to inquire about renters insurance through USAA. This type of insurance covers belongings not covered by your landlord’s policy (like jewelry and electronics).

Protect your loved ones with USAA’s life insurance. Choose from a variety of term lengths and levels of coverage so you can always afford the coverage you need.

In order to get the most comprehensive coverage possible, you should speak with a representative at USAA about which insurance coverage is right for you.

USAA Insurance Plan Pros and Cons

The following are some of the benefits of getting insurance through USAA if you’re looking for quality insurance.

There has been a long history of quality insurance products provided by USAA.

The company is known for its reliability and customer service.

A wide range of insurance plans are available from USAA, including plans for cars, homes, and businesses.

USAA insurance plans do not charge annual or monthly fees.

For members with military experience or veterans, USAA offers discounts on premiums.

When choosing USAA as your insurance provider, you should also consider the following cons:

There are some states where USAA does not provide coverage.

Health and life insurance are not offered by the company.

USAA’s high rates have been criticized by some customers.

In conclusion

In addition to their excellent customer service, USAA also offers some of the best rates in the industry. If you’re looking for an insurance company that has a great track record, USAA is a great choice. Also, USAA’s app makes managing your policy and paying your premiums easy. Look no further than USAA if you’re looking for the best insurance company for your family.