Real-World Assets on Blockchain: Hype or Reality?

- Blockchain

- February 12, 2026

- 8

For years, blockchain conversations revolved around cryptocurrencies and digital collectibles. Now, attention is shifting toward something more traditional: real-world assets. From U.S. Treasury bills to real estate funds, financial institutions and startups alike are experimenting with putting tangible assets on blockchain networks. The promise is simple—greater efficiency, broader access, and faster settlement. The question is whether this marks a structural change in finance or just another wave of experimentation.

What “Tokenizing” Real Assets Means

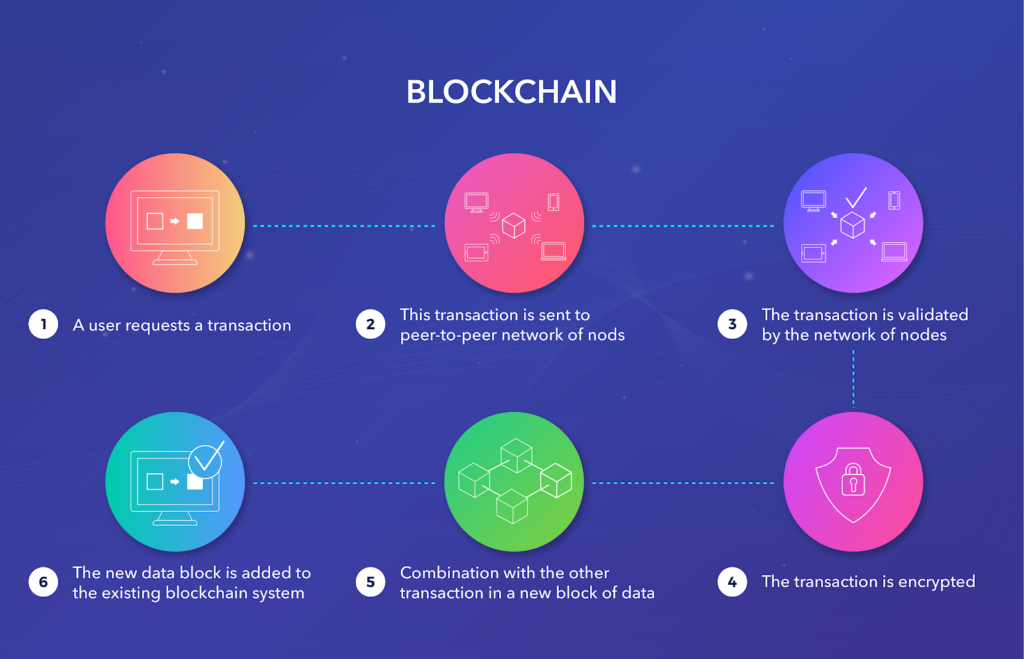

Tokenization refers to representing ownership of a real-world asset as a digital token on a blockchain. Instead of holding a paper certificate or relying solely on a centralized database, ownership is recorded on a distributed ledger. The underlying asset—whether a bond, fund share, or piece of property—remains real and regulated. The blockchain acts as a programmable record of who owns what.

In theory, this can make transferring ownership faster and reduce administrative friction. It can also allow fractional ownership, meaning investors can buy smaller portions of assets that were once accessible only to large institutions.

Treasury Bills Go On-Chain

One of the most concrete examples of real-world asset tokenization involves U.S. government debt. In 2023, asset manager Franklin Templeton launched a tokenized money market fund that records share ownership on a public blockchain. The underlying holdings include U.S. Treasury securities, but transactions are processed through blockchain infrastructure.

BlackRock followed with a tokenized fund on the Ethereum network, further signaling institutional interest. These are not crypto experiments in the traditional sense; they are regulated financial products using blockchain as a settlement and record-keeping layer.

The appeal is operational efficiency. Settlement can be faster, and certain back-office processes can be streamlined. At the same time, investors interact with familiar financial instruments rather than speculative tokens.

Real Estate Experiments

Real estate has long been cited as a candidate for tokenization because property transactions are slow and capital-intensive. Several platforms have explored issuing blockchain-based tokens that represent fractional ownership in properties or funds.

In the United States and Europe, regulated offerings have allowed investors to purchase tokenized shares in specific real estate projects. The properties themselves remain governed by existing legal frameworks; the blockchain simply records ownership stakes and, in some cases, automates distributions.

While adoption remains limited compared to traditional real estate markets, these projects show that tokenization can function within existing legal structures rather than outside them.

Bonds and Private Credit

Beyond government debt and real estate, banks have tested tokenized bonds and digital issuance platforms. JPMorgan has used blockchain-based systems to settle transactions between financial institutions. In some pilot projects, tokenized bonds have been issued and settled on distributed ledgers instead of traditional clearing systems.

These initiatives aim to reduce settlement times and operational costs. Instead of multiple intermediaries reconciling records, a shared ledger can serve as a single source of truth.

The Promise of Fractional Access

One of the most discussed benefits of tokenization is broader access. By dividing assets into smaller digital units, platforms can theoretically lower the minimum investment threshold.

This concept has practical examples. Some tokenized funds allow smaller entry points than comparable traditional vehicles. The broader vision is a more inclusive financial system where retail investors can access asset classes previously limited to institutions.

Whether this becomes widespread depends on regulation, investor demand, and how easily tokenized assets integrate with existing financial systems.

The Regulatory and Technical Reality

Tokenization does not bypass regulation. In most jurisdictions, tokenized securities must comply with the same rules as their traditional counterparts. That includes investor protections, disclosure requirements, and oversight.

Technical challenges also remain. Interoperability between blockchains, custody of digital tokens, and integration with legacy banking systems can complicate adoption. For many institutions, blockchain is an additional layer rather than a replacement for existing infrastructure.

Hype or Structural Shift?

Real-world asset tokenization has moved beyond white papers. Major asset managers, banks, and regulated platforms are actively testing and deploying it. That suggests more than pure hype.

At the same time, the scale is still small relative to global financial markets. Most bonds, funds, and property transactions continue to operate through traditional systems. Blockchain has not replaced them; it is running alongside them.

The likely outcome is gradual integration. If tokenization consistently reduces friction and cost without increasing risk, adoption may expand. If benefits remain marginal, it could stay a niche infrastructure layer.

For now, real-world assets on the blockchain represent a serious experiment—one rooted not in digital art or speculative tokens, but in the mechanics of finance itself. Whether it becomes the next financial shift depends less on technology and more on whether institutions and investors find the tradeoffs worthwhile.